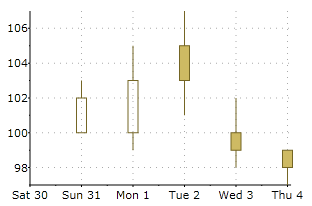

Candle Charts

A Candle chart is a special type of HiLoOpenClose chart that is used to show the relationship between the open and close as well as the high and low. Like HiLoOpenClose charts, Candle charts use the same price data (time, high, low, open, and close values) except they include a thick candle-like body that uses the color and size of the body to reveal additional information about the relationship between the open and close values. For example, long transparent candles show buying pressure and long filled candles show selling pressure.

The Candle chart is made up of the following elements: candle, wick, and tail. The candle or the body (the solid bar between the opening and closing values) represents the change in stock price from opening to closing. The thin lines, wick and tail, above and below the candle depict the high/low range. A hollow candle or transparent candle indicates a rising stock price (close was higher than open). In a hollow candle, the bottom of the body represents the opening price and the top of the body represents the closing price. A filled candle indicates a falling stock price (open was higher than close). In a filled candle the top of the body represents the opening price and the bottom of the body represents the closing price.

The following image represents the Candle chart when you set ChartType property to Candle and specifiy the data values for the XValuesSource, OpenValuesSource, CloseValuesSource, HighValuesSource, and LowValuesSource, like the following:

<c1chart:C1Chart ChartType="Candle">

<c1chart:C1Chart.Data>

<c1chart:ChartData>

<c1chart:HighLowOpenCloseSeries

XValues="1 2 3 4 5"

HighValues="103 105 107 102 99"

LowValues="100 99 101 98 97"

OpenValues="100 100 105 100 99"

CloseValues="102 103 103 99 98"

/>

</c1chart:ChartData>

</c1chart:C1Chart.Data>

</c1chart:C1Chart>