You can change the type of the FinancialChart control depending on your requirement. Chart type can be changed by setting the ChartType property of the FinancialChart control. In this case, if multiple series are added to the FinancialChart, all of them are of the same chart type.

Supported Chart types:

In Code

| Razor |

Copy Code

|

|---|---|

.ChartType(C1.Web.Mvc.Finance.ChartType.Renko) |

|

| HTML |

Copy Code

|

|---|---|

chart-type="C1.Web.Mvc.Finance.ChartType.Renko"

|

|

Area chart

An Area chart draws each series as connected points of data and the area below the connected points is filled with color to denote volume. Each new series is drawn on top of the preceding series. The series can either be drawn independently or stacked.

These charts are commonly used to show trends between associated attributes over time.

ArmsCandleVolume chart

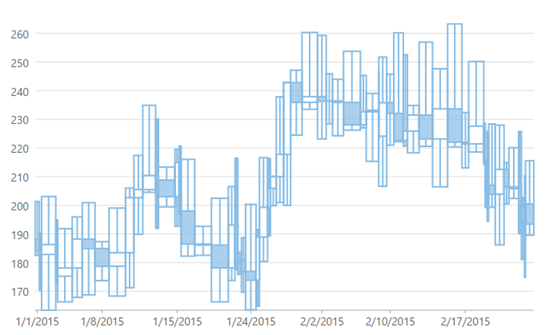

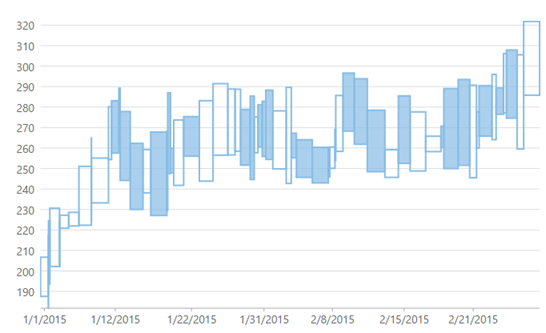

Candlestick chart

A Candlestick chart is a financial chart that shows the opening, closing, high and low prices of a given stock. It is a special type of HiLoOpenClose chart that is used to show the relationship between open and close as well as high and low. Candle chart uses price data (high, low, open, and close values) and it includes a thick candle-like body that uses the color and size of the body to reveal additional information about the relationship between the open and close values. for example:, long transparent candles show buying pressure and long filled candles show selling pressure.

Elements of a Candlestick chart

The Candlestick chart is made up of the following elements: candle, wick, and tail.

- Candle: The candle or the body (the solid bar between the opening and closing values) represents the change in stock price from opening to closing.

- Wick and Tail: The thin lines, wick and tail, above and below the candle depict the high/low range.

- Hollow Body: A hollow candle or transparent candle indicates a rising stock price (close was higher than open). In a hollow candle, the bottom of the body represents the opening price and the top of the body represents the closing price.

- Filled Body: A filled candle indicates a falling stock price (open was higher than close). In a filled candle the top of the body represents the opening price and the bottom of the body represents the closing price.

In a Candlestick there are five values for each data point in the series.

- x: Determines the date position along the x axis.

- high: Determines the highest price for the day, and plots it as the top of the candle along the y axis.

- low: Determines the lowest price for the day, and plots it as the bottom of the candle along the y axis.

- open: Determines the opening price for the day.

- close: Determines the closing price for the day.

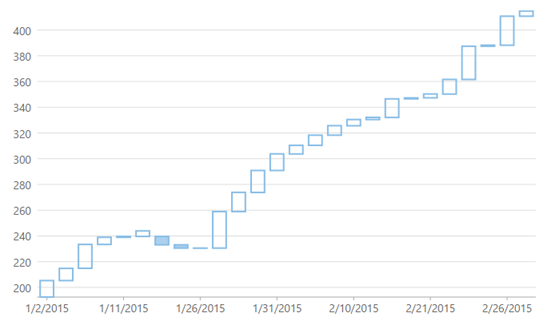

The following image shows a candlestick chart displaying stock prices.

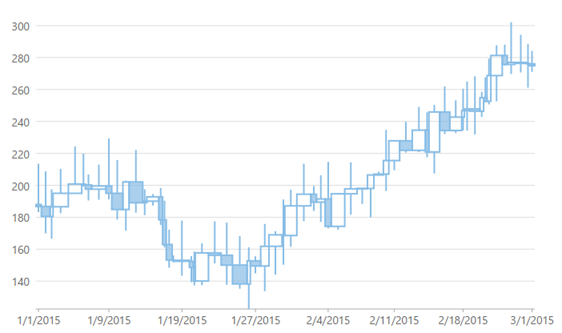

CandleVolume chart

CandleVolume charts are identical to standard Candlestick charts. The only difference is that the Volume determines the width of each bar in CandleVolume charts.

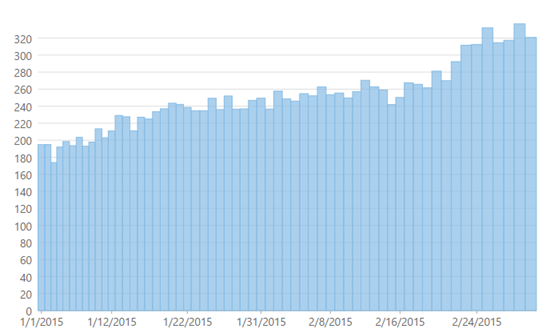

Column chart

A Column chart represents each series in the form of bars of the same color and width, whose length is determined by its value. Each new series is plotted in the form of bars next to the bars of the preceding series. In a column chart, bars are arranged vertically. Column charts can be either grouped or stacked.

These charts are commonly used to visually represent data that is grouped into discrete categories, for example: age groups, months, etc.

ColumnVolume chart

ColumnVolume charts are similar to Column charts, but width in these charts are determined by Volume value.

EquiVolume chart

EquiVolume charts are similar to candlestick charts, but the candlesticks in these charts are replaced with rectangular boxes of varying width (and no wicks). An EquiVolume box includes high and low price components with a third dimension, Volume that determines the width of each box. Color represents whether the close number is higher or lower than the previous box's close.

To know more about EquiVolume charts, read at StockCharts.com.

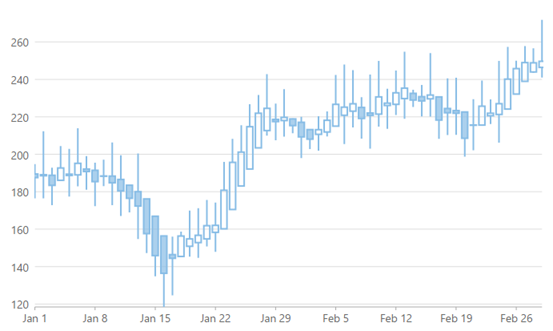

Heikin-Ashi chart

Heikin-Ashi charts are a variation of Japanese candlestick charts designed to remove noise from candlesticks and behave like a moving average. Heikin-Ashi charts are similar to Candlestick charts, but the method to calculate and plot candles on the chart is different for Heikin-Ashi. Each candle in Heikin-Ashi chart uses information presented by the previous candle. These charts are easier to read and interpret data.

These charts can be used to identify trends, potential reversal points, and other technical analysis patterns.

To know more about Heikin-Ashi charts, refer to What is Heikin-Ashi and How to Trade With It.

HighLowOpenClose chart

HiLoOpenClose are financial charts that combine four independent values to supply high, low, open, and close data for a point in a series. In addition to showing the high and low value of a stock, the Y2 and Y3 array elements represent the stock's opening and closing price, respectively.

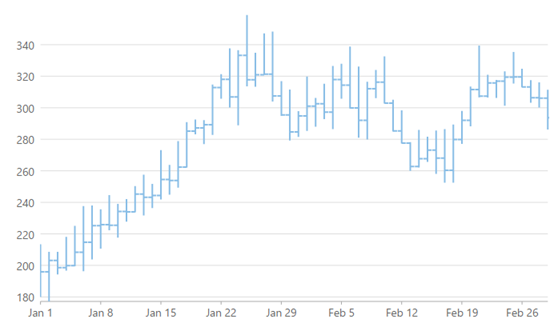

Kagi chart

A Kagi chart displays supply and demand trends using a sequence of linked vertical lines. The thickness and direction of the lines vary depending on the price movement. If closing prices go in the direction of the previous Kagi line, then that Kagi line is extended. However, if the closing price reverses by the preset reversal amount, a new Kagi line is charted in the next column in the opposite direction. Thin lines indicate that the price breaks the previous low (supply) while thick lines indicate that the price breaks the previous high (demand).

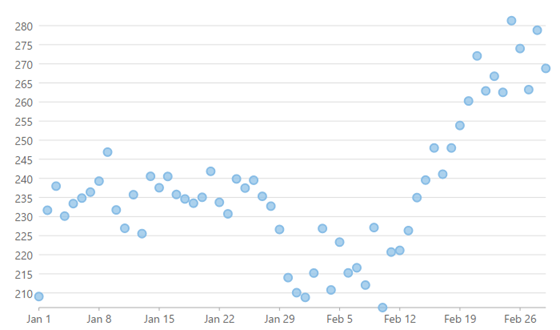

Line chart

A Line chart draws each series as connected points of data, similar to area chart except that the area below the connected points is not filled. The series can be drawn independently or stacked.

These charts are commonly used to show trends and performance over time.

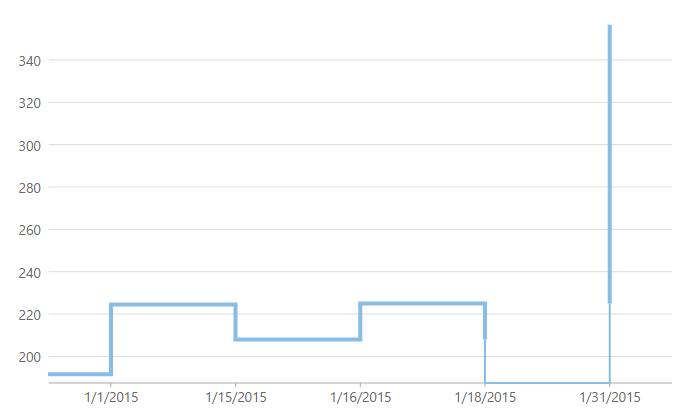

Line Break chart

A Line Break or Three Line Break chart uses vertical boxes or lines to illustrate the price changes of an asset or market.

Movements are depicted with box colors and styles; movements that continue the trend of the previous box are colored similarly while movements that trend oppositely are indicated with a different color and/or style. The opposite trend is only drawn if its value exceeds the extreme value of the previous n number of boxes or lines, which is determined by the newLineBreaks option.

Line Symbols chart

LineSymbol chart is similar to line chart except that it represents data points using symbols. It is the most effective way of denoting changes in value between different groups of data.

Renko chart

Scatter chart

A Scatter chart represents a series in the form of points plotted using their X and Y axis coordinates. The X and Y axis coordinates are combined into single data points and displayed in uneven intervals or clusters.

These charts are commonly used to determine the variation in data point density with varying x and y coordinates.